Most of the global population is facing new challenges and opportunities during the digitalization era. Indonesia has a significant change due to the emergence of fintech among the population. Market research Indonesia should focus on how to develop better and higher fintech service quality. However, the government and others, including the private sector, have a significant role to maintain.

Why Does Fintech Are Important?

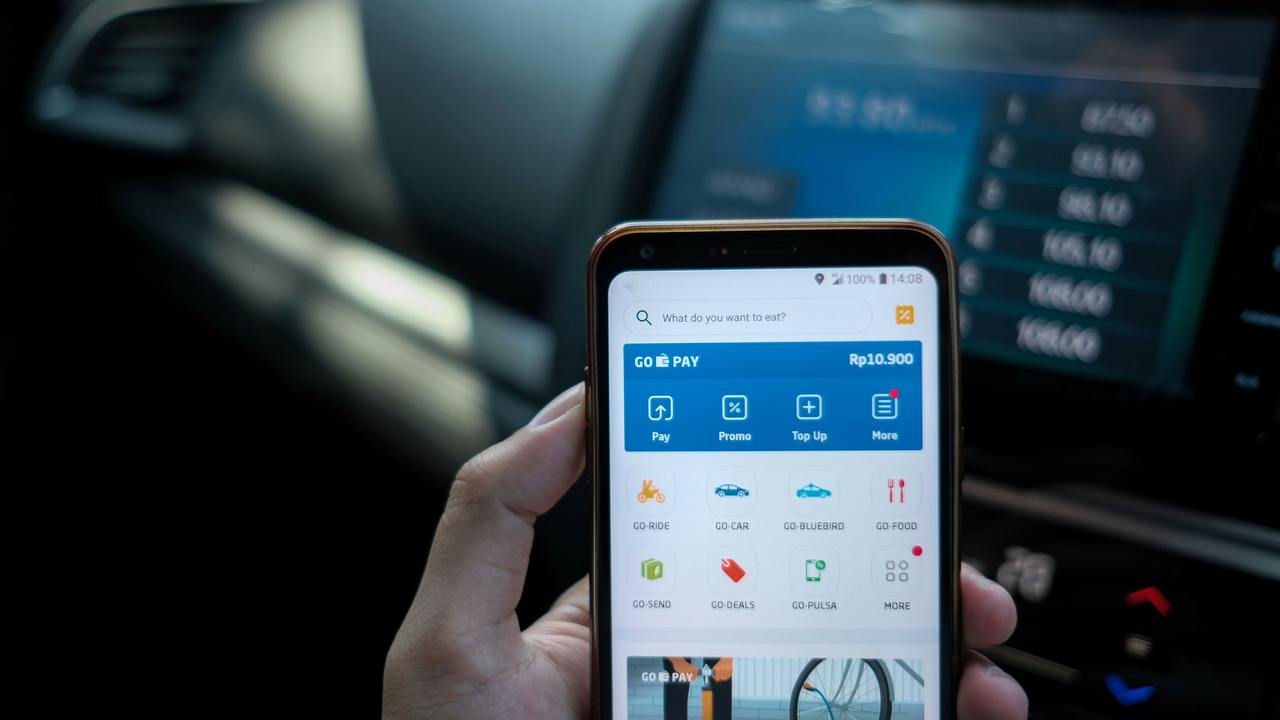

According to Otoritas Jasa Keuangan (OJK) in Indonesia, the role of fintech is to increase financial inclusion. Aiming to introduce financing products for citizens for having better financial situations. Particularly, fintech was used to describe new tech to improve and automate financial services. Involving the backend system to establish a financial institution.

Fintech startups in Indonesia are having potential growth. Thus, the Google and Temasek project counted if Indonesia’s digital economy is the largest in Southeast Asia. The market value approximately reached 27 billion in 2018 and might reach 100 billion in 2025. Represent as financing advice, wealth management, lending and borrowing system, fundraising method, payment, investment, and crypto.

How to Find the Best Fintech Market Entry in Indonesia?

- Look for the OJK vision and work on the strategy

Once you look for market research Indonesia on fintech, you might want to look at the OJK vision. The strategy is to further gain customer trust to become the best financing sector. Changing an old way of financing systems and applying technological advancement with IoT systems. Fintech companies should be able to gain OJK certified data for having customer trust.

- Find trusting model for citizens to invest

Fintech should be able to become a place for customers to invest. Including to get better value for their economic prosperity. Thus, people might be interested to put their money for better value. Companies should show significant improvement by leading the new technological platform. Since the platform effect does have a significant impact on customer trust.

- Local need would focus on funding

Indonesia is a country in ASEAN with a better economic situation. However, there are still a lot of local people who cannot find any prosperity for living. They would need more income to start the new journey. Funding must be the best options for better living and business. Fintech should be able to provide an easy way to fund rather than any commercial or local bank.

- Platform does give an impact

Indonesia’s citizens especially the younger would love to enjoy the impact of digitalization. They tend to be happy once a fintech revolution happens. Thus, you need to provide a high quality platform for better response from youngsters. It would have a significant impact on their trust by providing better transparency. Work with vision and target to provide more funds and investment. Along with the government strategy to increase people prosperity in Indonesia. Fintech can be able to provide significant solutions. Market research Indonesia is highly impacted by the digitalization among society. The need to have an easy transaction and effective ways to get funding or investing their money. Thus, the digital platform might need to develop and open for another market.